SHORT N SWEET

Since mid-June, news around the world has focused on the conflict between Israel and Iran. As with any major geopolitical event, investors face uncertainty about the impact these events might have on global economies and financial markets.

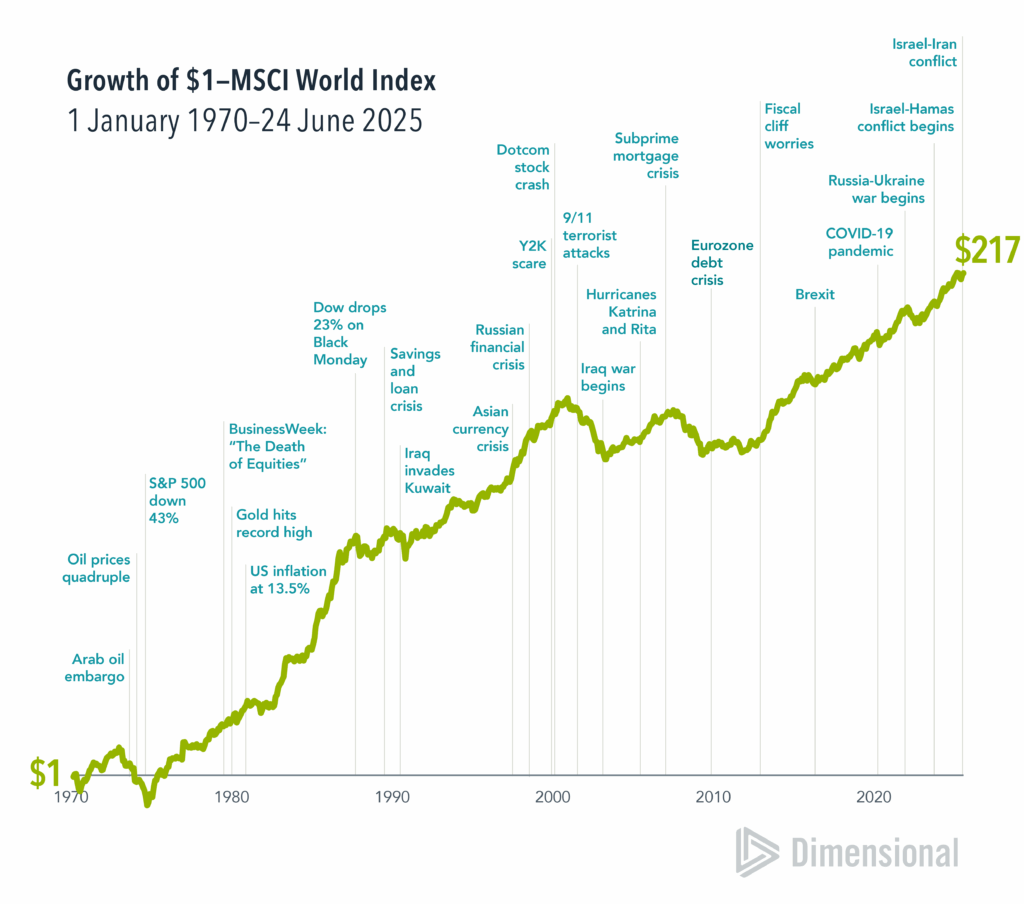

Taking a broad perspective, investing for the long run inevitably means weathering political and economic events that may cause market turmoil. Over the past 50+ years, investors have experienced challenges including double-digit inflation, financial crises, and a global pandemic. However, markets have consistently demonstrated their resilience, continually adjusting to new information and rewarding discipline in the long run. One dollar invested in the MSCI World Index in 1970 grew to $217 by 24 June 2025, despite numerous challenges along the way. Investors tempted to react to short-term turmoil may risk missing out on these longer-term returns.

Maintaining broad diversification and adhering to a sound financial plan remain reliable ways to stay the course and capture markets’ long-term growth potential.

Past performance is not a guarantee of future results.

In AUD. Source: MSCI World Index (net div.). MSCI data © MSCI 2025, all rights reserved. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

30 June 2025

By Karen Umland, Senior Investment Director and Vice President,

Dimensional Fund Advisers

This material is issued by DFA Australia Limited (incorporated in Australia, AFS License No. 238093, ABN 46 065 937 671). This material is provided for information only. This material does not give any recommendation or opinion to acquire any financial product or any financial advice product, and is not financial advice to you or any other person. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Investors should also consider the Product Disclosure Statement (PDS) and for the Dimensional Wholesale Trusts the target market determination (TMD) that has been made for each financial product or financial advice product either issued or distributed by DFA Australia Limited prior to acquiring or continuing to hold any investment. Go to dimensional.com/funds to access a copy of the PDS or the relevant TMD. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change.