Gold has been a topic of interest for centuries and remains a captivating focus for investors and analysts alike.

Historical Significance and Modern Relevance

Gold has been valued since ancient times as currency and a store of wealth. Today, gold remains a symbol of wealth and stability. Its unique properties, such as its scarcity and durability, contribute to its enduring value. The World Gold Council estimates that there are 212,582 tonnes of gold above ground, much of which has been mined since 19501.

Demand and Supply Dynamics

Various factors, including jewellery, industrial uses, and financial purposes, drive the demand for gold. According to the World Gold Council, 52% of the annual demand for gold is for jewellery, while 40% is for financial purposes, including investments in gold bars, coins, and gold-backed exchange-traded funds (ETFs). The remaining 8% comes from industrial users1.

Why Gold is in the Spotlight

Several factors contribute to the ongoing discussion about gold:

- Market Volatility: Gold is often considered a safe-haven asset during market turbulence2. Its value tends to remain stable or even increase when other investments are underperforming.

- Inflation Hedge: Gold is perceived as a hedge against inflation. Unlike cash, which can lose value due to rising prices, gold’s value remains stable.

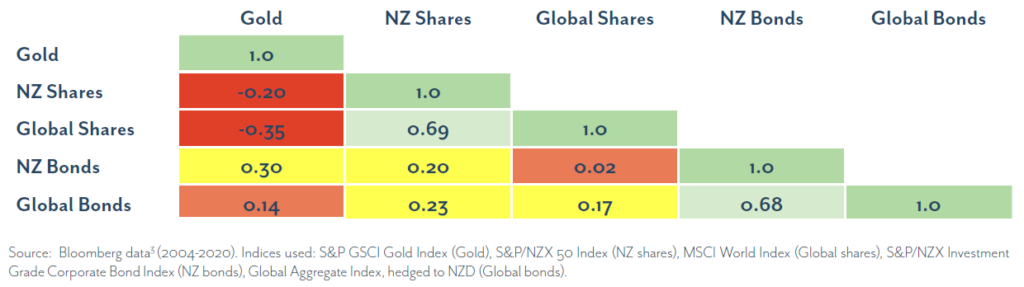

- Diversification: Gold’s low correlation with other asset classes, such as shares and bonds, makes it an attractive option for diversification. This means that gold can potentially cushion some losses when other investments are struggling3.

As illustrated below, the performance of gold prices has a low correlation with New Zealand and global shares and bonds. However, it is important to understand the risks.

Recent Performance

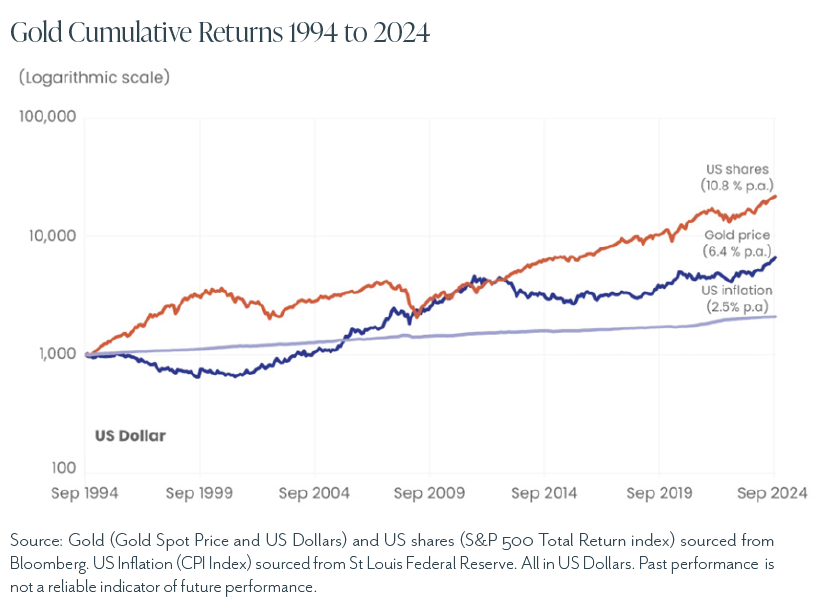

Gold has shown strong performance in recent years, rising 58% in US Dollar terms from September 2022 to September 20243. This increase occurred during a period of higher inflation, geopolitical risks, and declining interest rates.

Risks and Considerations

While gold has its merits, it is essential to be aware of its limitations and risks:

- No Income Stream: Gold does not generate income, unlike shares or bonds.

- Volatility: The price of gold can be highly volatile, and its value can fluctuate significantly over short periods.

- Lower Growth Potential: Over the long term, growth assets like shares have historically provided higher returns than gold.

- Investment Options: While purchasing gold jewellery and bullion is one method of investment, exchange-traded funds (ETFs) provide another option for investors.

We advise our clients to make informed decisions by thoroughly evaluating all available investment options. Should you wish to gain further insights into gold investments, please do not hesitate to contact us.

28 April 2025

References:

1 National Mining Association, The History of Gold

2 iShares, Diversify your portfolio with gold.

3Bloomberg